Startup Sells for $50M. Founder Walks Away With $0.

“Learn how ugly VC terms can drain a founder’s exit upside and how Unstuck VC protects you. Because raising capital shouldn’t mean sacrificing everything you’ve built.

Wait, what?

Welcome to the world of venture capital, where everyone else can get paid before the person who actually built the thing.

Why It Happens

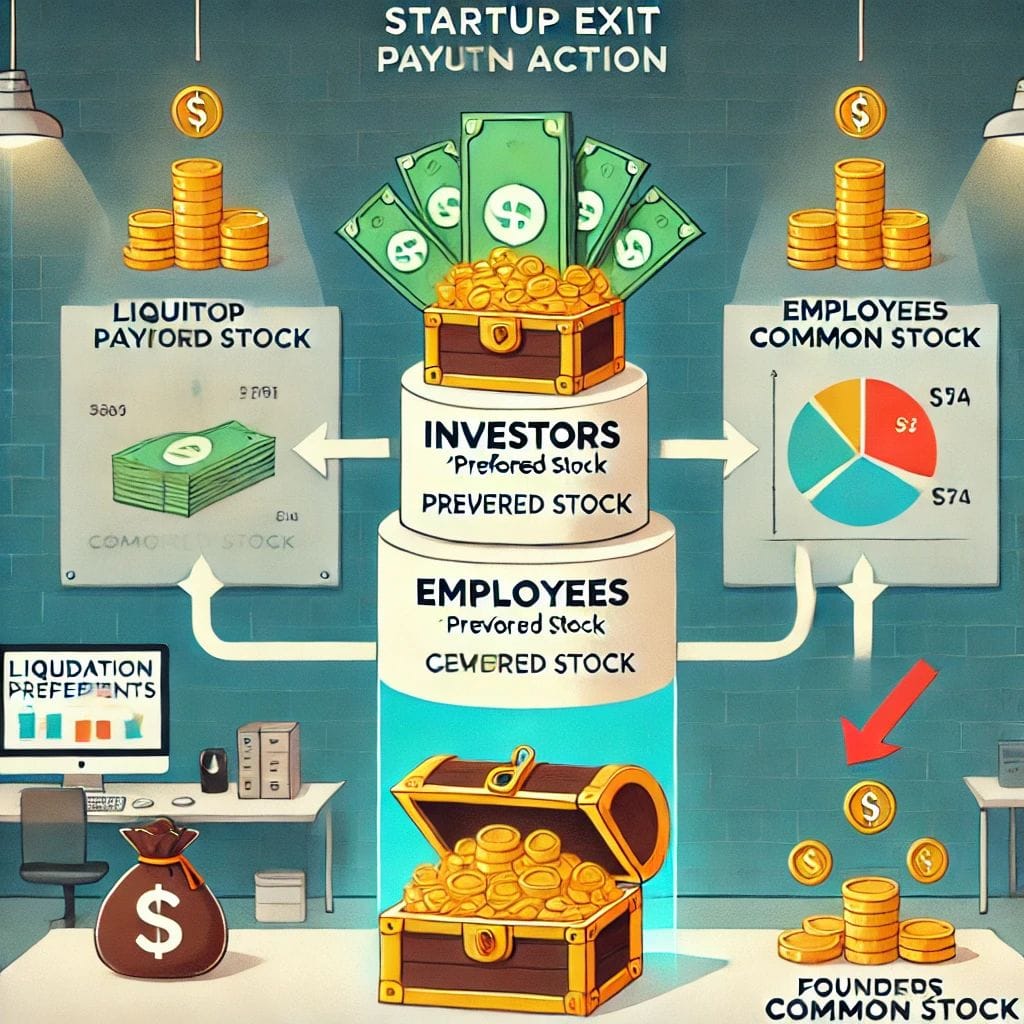

Too many first-time founders are chasing big headlines and multi-million-dollar term sheets, without really knowing what they’re signing. A “high” valuation can be overshadowed by harsh liquidation preferences, participating preferred, or board control that leaves the founder with scraps (or nothing) at exit.

Below are the common pitfalls that can leave founders with empty pockets despite an eye-popping sale price:

- Liquidation Preferences

Raised $20M? Those investors want their $20M back first—and, in some cases, they might want 2x or more. So your $50M acquisition quickly becomes $10M net to distribute, and that’s before you factor in other demands. - Participating Preferred

Some investors get their initial investment back and share in the remaining proceeds alongside common stock. They’re essentially double-dipping, slicing your exit upside down to crumbs. - Dilution

Each funding round can drastically shrink your ownership. Today you own 50%, tomorrow it’s 5%, and you might wake up one day realizing you barely have a claim to your own company. - Exit Below Last Valuation

When your last funding round valued the company at $100M but you exit at $30M, the entire liquidation stack can go to preferred shareholders—often leaving the founder with zero. - Board Control

If VCs hold a majority or influential share of board seats, they can push for an exit you never wanted or block the exit you do want. Founders are sometimes sidelined from critical decisions. - Salary Cap

Despite being CEO, you might need investor permission to pay yourself a modest raise. If growth slows, guess whose salary gets cut first? Yours.

How Founders Miss This

Most of these details are buried in legalese. Everyone is too busy “flexing” on LinkedIn about the “$5M seed funding!” to talk about the real trade-off behind the scenes. Desperate for “runway,” many sign term sheets they never fully understood. Often, the valuation looks amazing but the hidden terms are a ticking time bomb.

Raising VC isn’t about trophies. It’s a trade: you are giving up certain controls and potential upside to access capital. If you don’t read the fine print, you quickly become an employee with a fancy title—not the true CEO.

Cautionary Tales

- Fab.com: Raised $330M at over $1B valuation, sold for $15M.

- Jawbone: Raised $900M, delivered zero return.

- SugarSync: Raised $50M+, sold for under $10M.

- Color Labs: Raised $41M, shut down, founders walked away with nothing.

Before you chase a big valuation, ask: “What if we exit for far less than a billion?” Because sometimes an exit is just a prettied-up failure, and founders end up with no real gain.

How Unstuck VC Is Different

At Unstuck VC, we don’t just “put money in and hope.” We operate as a Venture Capital Studio, meaning we actively co-build and guide startups using a proven blueprint approach. Here’s how we stand out:

- Hands-On Partnership

We don’t treat entrepreneurs like lottery tickets. We commit our resources, expertise, and network to help you maximize success—not push for an early exit that leaves you empty-handed. - Aligned Incentives

We’re transparent about our term sheets. Our preference structures are designed so that success is shared and founders are never blindsided by hidden gotchas. It’s about mutual growth, not just investor upside. - Long-Term Vision

We selectively onboard ventures that solve real problems and show sustainable potential. We don’t chase hype. When we invest, we roll up our sleeves to ensure that each company is healthy and has a path to real success. - Blueprint Approach

We have a structured methodology—our blueprint—for scaling a startup responsibly: from market validation to product development, team building, go-to-market strategy, and beyond. That means less guesswork and more guided growth. - Founders First

We believe that founders should remain meaningfully involved and incentivized. That’s why we limit control over day-to-day operations and avoid oppressive salary caps. Our goal is for you to keep building and innovating.

Yes, venture capital can be a powerful tool. But raising money without wisdom can cost you your dream. With Unstuck VC, you have a partner that invests holistically in your success—ensuring you not only secure the funding you need but also retain control and upside so your life’s work truly pays off.

Special thanks for the insights about this article: Gerald Duran